You can donate items to Thrift-ish By completing the form below.

If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Thrift-ish donations.

According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them. Value usually depends on the condition of the item. By law, a charity cannot tell you what your donated items are worth. This is something you must do yourself. To assess “fair market value” for your donations:

Consult a local tax advisor who should be familiar with market values in your region.

Review the following tax guides available from the IRS.

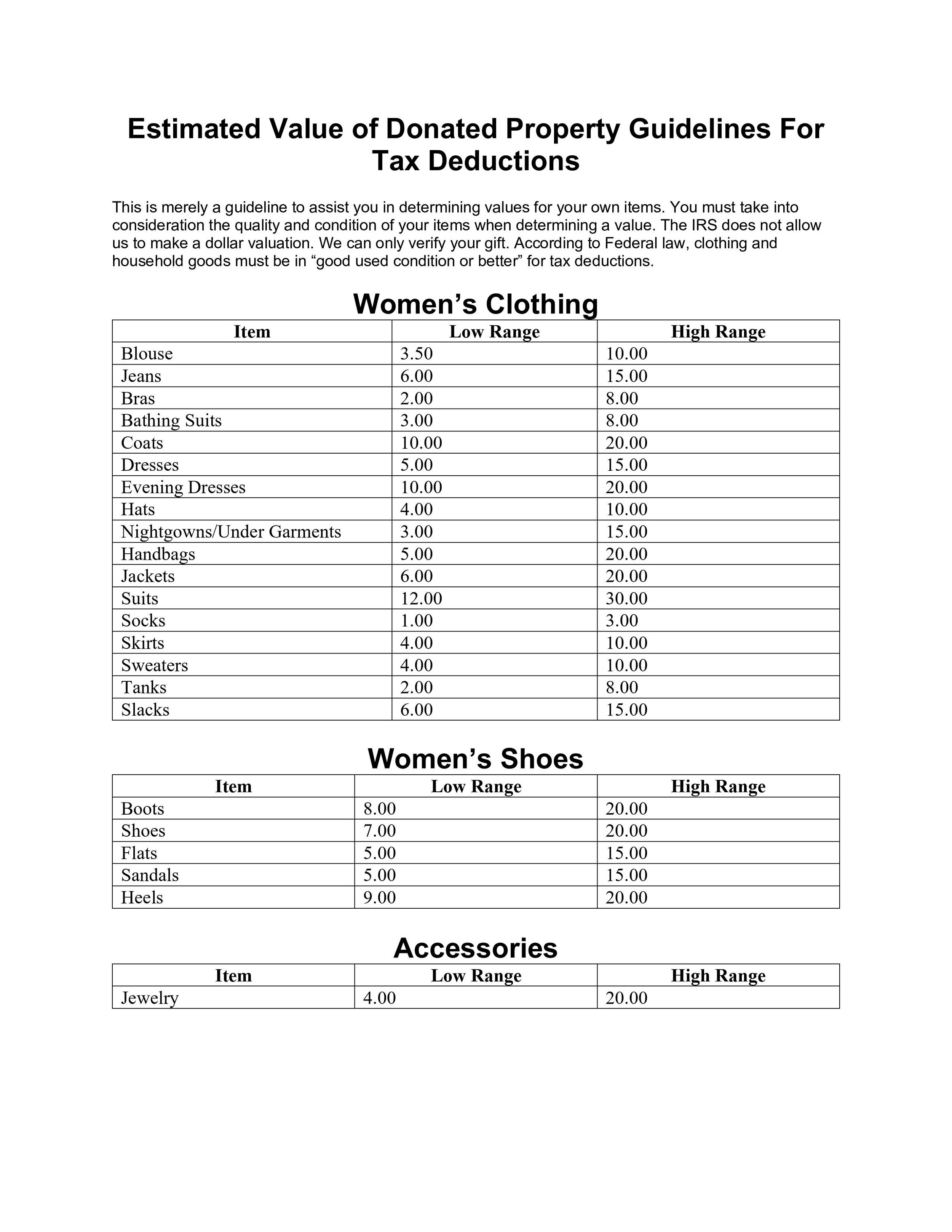

Determining the Value of Donated Property defines “fair market value” and helps donors and appraisers determine the value of property given to qualified organizations. It also explains what kind of information you must have to support the charitable contribution deduction you claim on your return. To help you determine your donations fair market value Thrift-ish is happy to provide a Value Guide (Please see below) that offers average prices in our stores for items in good condition.

If a donor is claiming over $5,000 in contribution value, there is a section labeled “Donate Acknowledgement” in Section B, Part IV of Internal Revenue Service (IRS) Form 8283 that must be completed. The form and instructions are available on the IRS site and can be accessed through this link, IRS Tax Forms.

Thrift-ish will be happy to provide a receipt as substantiation for your contributions in good used condition, only on the date of the donation. You may request a donation receipt with dropping off donations at one of our attended donation centers.

Estimated Value of Donated Property Guidelines For Tax Deductions

This is merely a guideline to assist you in determining values for your own items. You must take into consideration the quality and condition of your items when determining a value. The IRS does not allow us to make a dollar valuation. We can only verify your gift. According to Federal law, clothing and household goods must be in “good used condition or better” for tax deductions.